R&D Tax Specialists Have Your Back

In-house experts prepare and validate your claim, applying their collective decades of experience in finance, tax, and technology to maximize your eligibility.

A team of experts with the experience necessary to prepare and defend your next R&D Tax claim.

White Glove Service

We take the pressure off of you by authoring your technical reports, reviewing claims and eligibility, and ensuring everything possible is done to maximize your claim. With decades of combined experience, our technical and service experts make your process easy and your claim more accurate.

Regular Check-ins

Getting the most from your innovation investments means regularly monitoring qualifying work—not just once a year in a mad rush at deadline time. Boast makes it easy to stay updated with our automated software and integrations, but our experts will check in with you regularly to discuss options.

A Proven Process, Without the Mystery

Our transparent, real-time process is easier and more accurate, eliminating that painful end-of-year deadline scramble.

Access Your SR&ED Refund Up To 12 Months Early So You Can:

- Re-invest in your business

- Grow faster

- Hire sooner

- Extend your cash runway

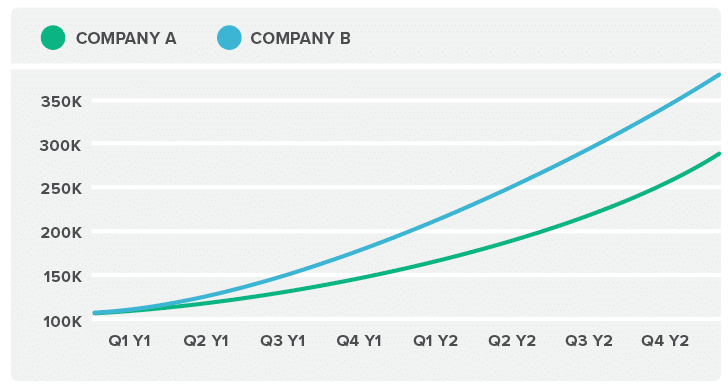

Companies that leverage QuickFund grow much faster than their counterparts

Since company B was able to leverage SR&ED Financing to get quarterly advanced funding, they were able to increase their growth rate one year ahead for Company A.

Find Out How Much Money You Can Get From The Government

Our R&D tax experts will quickly assess if you are eligible for R&D tax credits. During this conversation we will provide:

- Tactics to reduce your teams time in preparing your R&D tax credits

- Determine what projects qualify for R&D tax credits

- Assess if you qualify for quarterly cash advances on accrued R&D tax credits

- Estimate the total return you can expect in your current fiscal year

- Provide ideas to maximize your current and past claims

- Learn about the Boast platform, and how we simplify your claim process