What is Database Storage R&D Tax Credit?

The Database Storage R&D Tax Credit is a federal tax credit that can be used as tax relief to offset the cost of research and development activities related to database storage technologies. The credit is intended to encourage companies to invest in new and innovative data storage technologies that can help improve the efficiency and effectiveness of their operations.

To be eligible for the credit, a company must have qualifying expenditure related to the development or improvement of a database storage technology. Qualified research expenses include wages paid to the data scientist and other employees who are engaged in qualified research activities, as well as the costs of supplies and equipment used in those activities.

It can also be used to offset the costs of designing, developing, and testing new database storage technologies. It can also be used to offset the costs of both in-house and contract research expenditures, cloud and data costs, as well as the costs of deploying and using those technologies in a business setting.

Database Storage R&D Tax Credit vs. Cloud Tax Credit

The database storage R&D Tax Credit is based on improving the functionality of databases, such as developing new or improved database management software, algorithms, architectures, and networking protocols. In order to qualify, your company’s primary purpose for the research must be to make your product work with a particular type of database or databases in general. Additionally, the research activities must go beyond merely designing the database; they must also include improving how the database actually functions.

The Cloud R&D Tax Credit, on the other hand, is available for companies developing new or improved cloud-based products and services such as cloud computing services, and cloud infrastructure. The credit can help offset qualifying expenditures, for example, cloud computing costs, digital technology expenses, cyber security investments, quality assurance, and more.

To qualify, your company’s primary purpose for the research must be to make your product work in a cloud environment or to improve the performance of your product in a cloud environment. Additionally, the research activities must go beyond merely designing the product; they must also include developing or improving the algorithms, architectures, and networking protocols that make your product work in a cloud environment.

So, which R&D Tax Credit is right for your company? If you’re not sure, the best way to find out is to speak with a qualified tax professional who can help you determine which credit you may be eligible for.

Database Storage R&D Tax Credit vs. Backup Publishing R&D Tax Credit

The Database Storage R&D tax credit is designed for companies that are developing new ways to store data. This can include developing new methods of storing data, improving existing storage methods, or developing new software to manage data storage. To be eligible, your company must be engaged in the theoretical or practical application of knowledge in the field of database storage.

To qualify, your company must be able to demonstrate that it is seeking to improve the function, performance, or capacity of its database storage products. Your company must also be able to show that it has incurred qualified research expenses in relation to this work. Qualified research expenses can include salaries for employees working on the project, materials and supplies used in the research, and outside contractor fees.

Meanwhile, the Backup Publishing R&D tax credit is designed for companies that are developing new ways to publish data backups. This can include developing new methods of backing up data, improving existing backup methods, or developing new software to manage data backups. To be eligible, your company must be engaged in the theoretical or practical application of knowledge in the field of backup publishing.

To qualify, your company must be able to demonstrate that it is seeking to improve the function, performance, or capacity of its backup publishing products. Your company must also be able to show that it has incurred qualified research expenses in relation to this work. Qualified research expenses can include salaries for employees working on the project, materials and supplies used in the research, and outside contractor fees.

- Telecommunications

- Software Development

- Data Management

- Enterprise Resource Planning

- Business Intelligence

- Information Technology Consulting

Potentially Qualifying Industries

There are many potential industries that could qualify for the Database Storage R&D tax credit such as:

- Telecommunications

- Software Development

- Data Management

- Enterprise Resource Planning (ERP)

- Business Intelligence

- Information Technology Consulting

Each of these industries could potentially qualify for the Database Storage R&D tax credit if they can demonstrate that they are conducting eligible research and development activities. The specific activities that would be eligible for the credit would vary by industry, so it is important to work with a tax professional to determine if your business qualifies.

Database Storage R&D Tax Credit Eligibility

To be eligible for the Database Storage R&D tax credit, a business must invest in R&D activities that improve or create new database storage technologies. Activities that qualify for the credit include:

- Designing and developing new or improved database storage technologies

- Planning and conducting experiments to test the feasibility of new or improved database storage technologies, and to help market faster

- Development work on prototypes of new or improved database storage technologies

- Conducting analysis to determine the technical feasibility of new or improved database storage technologies and scientific data

- Revising existing database storage technologies to achieve greater efficiency, innovation, or performance

The Database Storage R&D tax credit is available to businesses in all industries, including for-profit businesses and non-profit organizations. However, the credit is particularly beneficial for companies in high-tech industries such as software development, information technology, and telecommunications. These companies often have large R&D budgets and can therefore claim significant credit.

How to Claim Database Storage and Backup Software Publishing Tax Credit

The Database Storage and Backup Software Publishing Tax Credit is a credit that is available to businesses that publish or distribute software that is used for data storage or backup. This credit can be claimed by businesses that have expenses related to the publishing or distribution of this software.

This credit can be claimed for any year that the business publishes or distributes data storage, data silos, or backup software. However, businesses can only claim credit for expenses that are related to the publishing or distribution of this software. Expenses that are related to the development or manufacture of the software are not eligible for the credit.

If your company is eligible for the R&D Tax Credit, you can claim tax credits against your federal income taxes equal to a percentage of your eligible research expenses. The credit can be used to offset both regular tax liability and Alternative Minimum Tax (AMT) liability.

To claim the R&D Tax Credit, your company will need to file Form 6765 with the IRS. The form must be filed with your company’s annual tax return. If you have questions about the R&D Tax Credit or whether your company is eligible, please contact a tax professional for support.

How We Can Help

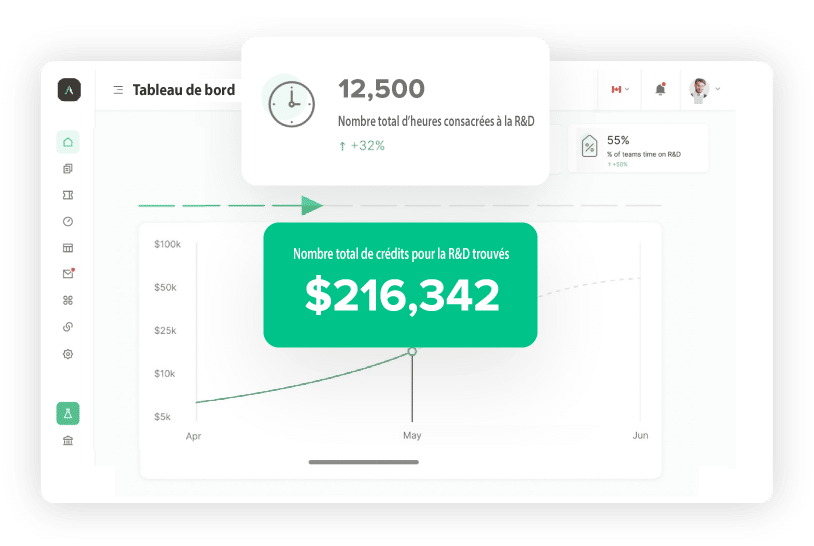

Boast gives cutting-edge organizations the ability to claim tax credits for their database storage research and development expenses. Our team of engineers and accountants uses our unique software to help you prepare and estimate your claims. This allows you to submit your claims faster, more accurately, and with bigger reimbursements. After using Boast, our clients have greater cashback from R&D with fewer audit risks.

Automated R&D Tax Credits for Database Storage & Backup Software Publishing

- Payroll

- Accounting

- Jira

- Github

The Boast platform gathers data from your technical and financial systems to identify and categorize eligible projects, time, and expenses—estimating along the way instead of only at the end—and getting you more money, faster, for less time, and risk.

- Time Tracking

- Cash

- Audit Evidence

- Tax Forms

Frequently Asked Questions

Q:What are Qualified Expenses for the Database Storage R&D Tax Credit?

- Wages paid to employees working on the project

- Contract labor expenses

- Software development costs

- Hardware development costs

Find Out How Much Money You Can Get From The Government

Your free 1-hour consultation includes a detailed review of our platform, your projects, processes, and financial data by one of our R&D Tax experts.

Talk to one of our experts to see how outsourcing your R&D tax claims to Boast can get you more money back from the government and help you regain the time you need to run your business.

Fill out the form to schedule your demo.