Telecommunications R&D Tax Credit

The Telecommunications Tax Credit is available to businesses that invest in eligible telecommunications property. The credit is intended to encourage companies to upgrade their telecommunications infrastructure, resulting in improved service for customers and increased efficiency for the business.

The credit may be used to pay for technological development and improvements. It can help offset the costs of technology upgrades and innovations for satellite providers, and cable companies. The amount of the credit is equal to 30% of the eligible investment, with a maximum credit of $1,000,000 per year. The credit may be claimed on the business’ annual tax return.

It has several other advantages for the communication, internet, and television service industries. These include better cash flow and financial flexibility, as well as incentives for R&D-related expenditures. Qualified businesses can also utilize the tax credit to reimburse money spent on research and development (R&D) projects and local taxes owed.

Internet Service Providers R&D Tax Credits

As an Internet service provider (ISP), you may be eligible for R&D tax credits. The credit can offset up to 20% of your eligible R&D expenditures, making it a valuable tool to help reduce the cost of your research and development activities.

To be eligible, your R&D must meet the following criteria:

- It must be undertaken to achieve an advance in science or technology.

- It must fall within one or more of the ‘specified activities’ defined by the legislation. These include system analysis and design, software development and testing, and hardware development.

- The work must involve some element of uncertainty or risk – that is, there must be doubt about whether the outcome can be achieved or the method of achieving it.

The government continues to invest in the country’s digital economy. Because of this, ISPs may qualify for other generous government incentives. The Scientific Research and Experimental Development (SRED) Program offers refundable tax credits of up to 20% of eligible R&D expenditures.

Community Internet Provider

R&D Tax Credits are also available to community internet providers in rural areas and communities with no current providers. Cable companies, satellite companies, and other telecommunications businesses can use the credit to invest in high-speed infrastructure and provide service to low-income households.

To qualify for the incentive, providers who cater to underserved areas must meet quality standards set by the Federal Communications Commission. Providers who do not meet these standards may still be eligible for the benefit if they agree to improve their service.

R&D Tax Credits have helped increase access to quality internet service in underserved communities. The credit has likewise propelled economic development in these locations. Business-wise, it has enabled providers to expand to untapped markets.

Telecommunications R&D Tax Credit

The R&D Tax Credit aims to encourage R&D initiatives that will drive new or improved telecommunications technologies. Small and large companies that incur costs related to qualified research activities are eligible for it.

Examples of qualified research activities include:

- Designing custom communication networks for specific uses, examples include long-distance calls and high-speed data transmission

- Assimilating new materials to improve product design and performance

- Establishing new production and testing measures for quality assurance

- Testing prototypes

The tax credit has helped many companies offset the costs of researching and developing new products and services. What’s more, the government grants it on a per-project basis. This means companies can receive tax credits for different projects at a time.

Qualified companies can use the incentive to offset federal and local taxes. Other tax credit eligible expenses include:

- Wages paid to employees who are directly involved in R&D tasks

- Compensation for managers and supervisors who directly oversee employees’ work

- Research and experimentation expenses

- Certain contract research expenses (i.e., tapping third-party groups to provide research support)

Eligible companies can claim the credit based on their tax liability for the year they conducted the research. They can carry unused credits forward for up to twenty years.

How We Can Help

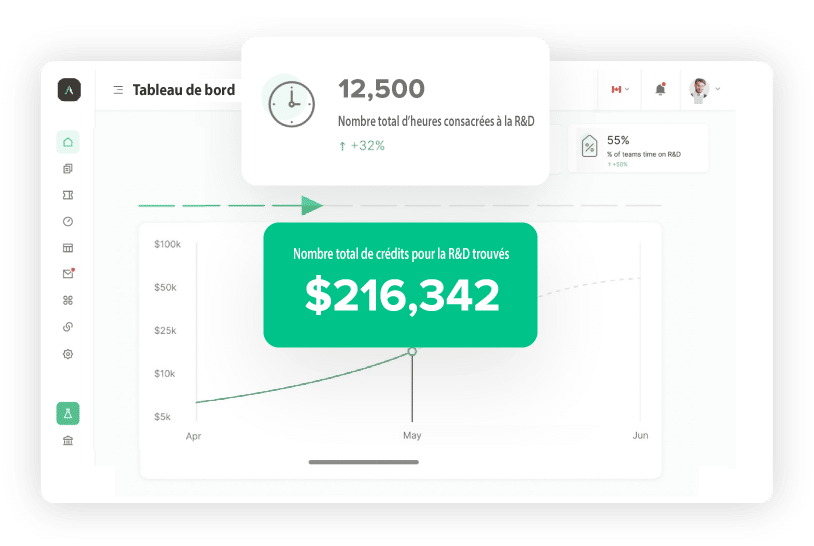

Boast helps innovative companies recover their R&D expenses from the government. Businesses can create more accurate claims, submit them faster, and enjoy larger reimbursements. This approach likewise enables Boast clients to increase their R&D tax claims while lessening audit risks at the same time. Our team of engineers and accountants uses AI-powered software to prepare and estimate tax claims throughout the year.

Automated R&D for Satellite Telecommunications Providers

- Payroll

- Accounting

- Jira

- Github

The Boast platform gathers data from your technical and financial systems to identify and categorize eligible projects, time, and expenses—estimating along the way instead of only at the end—and getting you more money, faster, for less time, and risk.

- Time Tracking

- Cash

- Audit Evidence

- Tax Forms

Frequently Asked Questions

Q:How do I know if I’m eligible?

Q:What counts as qualified research?

Q:How do I claim the credit?

Q:Are there any other requirements?

- Costs incurred from leasing or buying satellite equipment

- Fees paid to cable companies and satellite companies for satellite capacity

- Fees paid for ground station facilities

- Eligible businesses can use the R&D Tax Credit to offset both federal and local taxes owed.

Q:How long do I have to claim the credit?

Find Out How Much Money You Can Get From The Government

Your free 1-hour consultation includes a detailed review of our platform, your projects, processes, and financial data by one of our R&D Tax experts.

Talk to one of our experts to see how outsourcing your R&D tax claims to Boast can get you more money back from the government and help you regain the time you need to run your business.

Fill out the form to schedule your demo.